Bonds

1-year T-bill yield rebounds to 3.58%. Why the bounce?

By Gerald Wong, CFA • 18 Apr 2024 • 0 min read

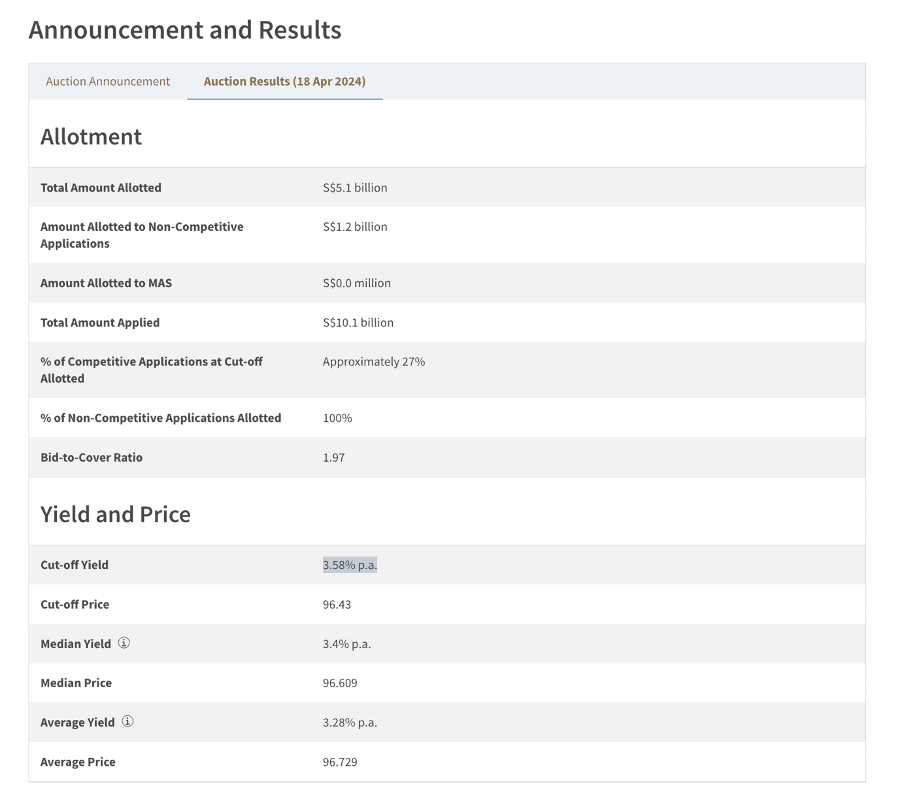

The cut-off yield on the latest 1-year Singapore T-bill auction on 18 April rebounded to 3.58%.

In this article

What happened?

Like many others, I was eagerly anticipating the result of the 1-year Singapore T-bill auction today.

I was glad to see that the cut-off yield on the 1-year T-bill (BY24101X) rose to 3.58% in the latest auction on 18 April 2024.

The higher cut-off yield may not come as a surprise to some investors in the Beansprout community.

After all, we have seen the T-bill yield rebounding in the past few weeks. The yield on the latest 6-month Singapore T-bill has also remained elevated at 3.75%.

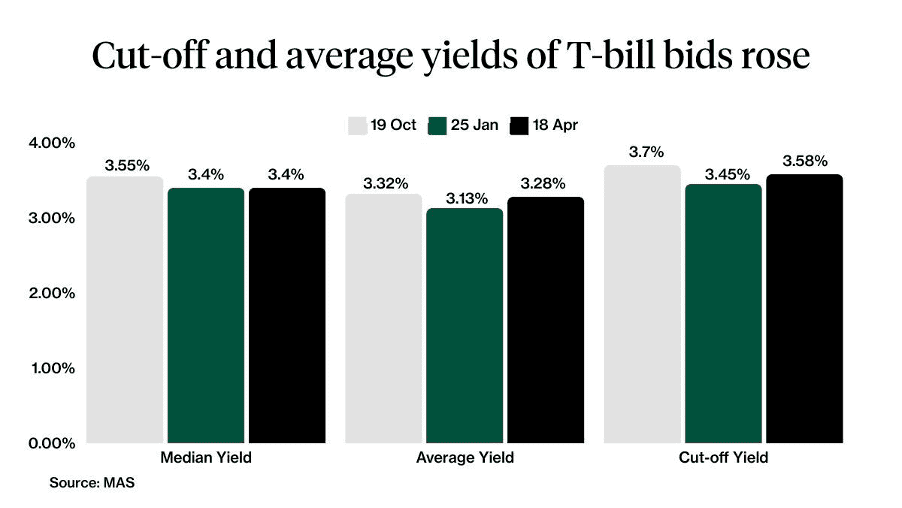

The cut-off yield of 3.58% would be higher than the previous 1-year T-bill auction in January, and similar to the yield in the auction in April 2023.

Let us dive deeper to understand more about what is driving the higher yield on the 1-year T-bill.

What we learnt from the latest 1-year Singapore T-bill auction

#1 – Fall in demand for latest T-bill

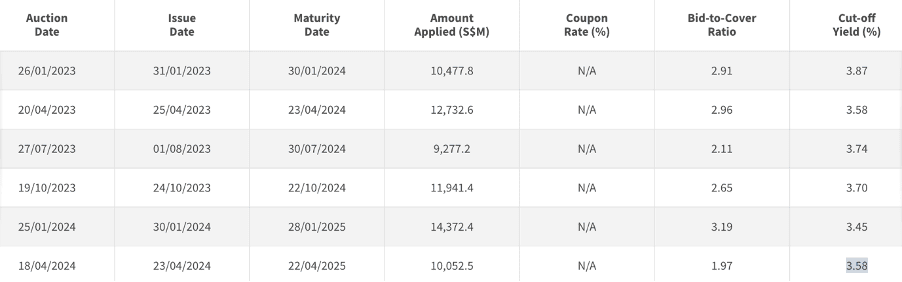

The total amount of applications for the latest Singapore 1-year T-bill was S$10.1 billion, declining from S$14.4 billion in the auction in January 2024 and S$11.9 billion in the auction in October 2023.

The amount of competitive bids fell to S$8.9 billion from S$12.6 billion in the previous auction.

The amount of non-competitive bids fell to S$1.2 billion from S$1.8 billion in the previous auction.

As the S$1.2 billion of non-competitive bids is within the allocation limit, eligible non-competitive bids were able to get 100% allocation at the cut-off yield of 3.58%.

The fall in demand for the 1-year T-bill is in sharp contrast to the 6-month T-bill, where demand surged to a record high of S$16.0 billion in the auction on 11 April.

In our view, this might be because the previous 6-month T-bill offers a higher cut-off yield of 3.75%, compared to the previous 1-year T-bill which offers a cut-off yield of 3.45%.

#2 – Higher average yield submitted

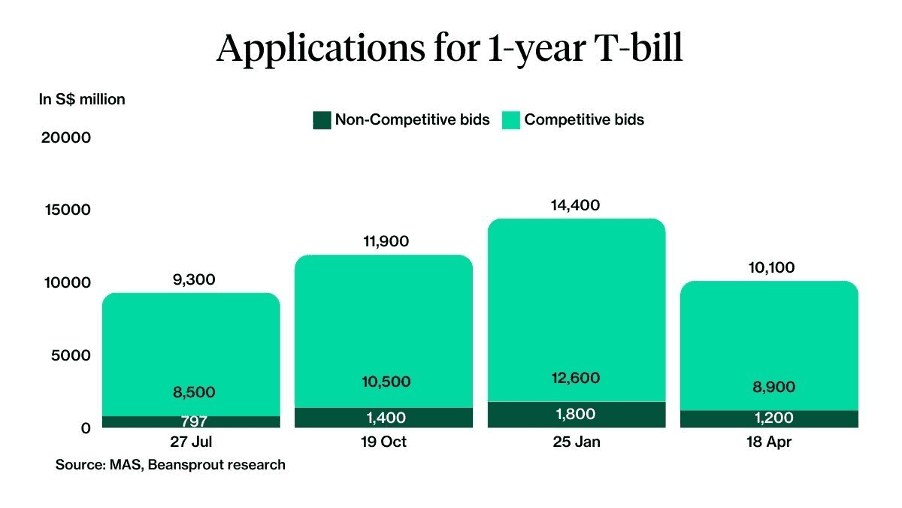

The average yield of bids submitted rose to 3.28% from 3.13% in the previous auction.

The median yield of bids submitted was stable at 3.4%, unchanged from the previous auction.

The increase in average yield of bids submitted in the latest T-bill auction would reflect the recent increase in bond yields, after persistent inflation led investors to expect a slower pace of interest rate cuts by the US Federal Reserve.

#3 - Rise in T-bill yield in contrast to decline in fixed deposit rates

The increase in cut-off yield for the 1-year T-bill is in contrast to with the fall in fixed deposit interest rates in April 2024.

For example, UOB has cut its 10-month fixed deposit rate to 2.60% p.a. from 2.70% p.a. previously.

Recently, we also saw UOB announcing that the interest rate on the UOB One savings account will be cut from May 2024.

As a result of this divergence, the cut-off yield on the 1-year T-bill is now significantly higher than the best 1-year fixed deposit rate of 3.20% p.a.

What would Beansprout do?

The increase in cut-off yield for the latest 1-year Singapore T-bill appears to be driven by a fall in demand, as well as higher average yield of bids submitted.

The higher yield submitted would be consistent with the increase in government bond yields in recent weeks, as US inflation remains persistent.

As the cut-off yield on the 1-year T-bill is significantly higher than the best 1-year fixed deposit rate, we continue to consider the T-bill as a safe way to earn a higher return on our savings in the short term.

For those who were successfully allocated the 1-year T-bill, check out our CPF T-bill calculator to find out how much more interest you would potentially earn with the latest 1-year T-bill.

If you did not get your planned allocation for the latest 1-year T-bill, there will be a 6-month T-bill auction on 25 April.

We can also consider alternatives to allow our savings to work harder in the meantime.

For example, cash management accounts allow you to earn a potentially higher return on your cash in a relatively safe way.

To learn more about the T-bill including how to apply, check out our comprehensive T-bill Guide.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Use our CPF-Tbill calculator to find out how much more interest you can potentially earn by investing in the Singapore T-bill using your CPF OA savings.

This article was first published on 18 April 2024 .

Read also

Want to learn more? Discover more Bond-related insights here.

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

0 comments